Using a Walmart credit card for casino-related transactions is a nuanced topic. What casino can I pay with a Walmart credit card. While Walmart credit cards, issued through Capital One, are widely accepted at merchants using Mastercard, their use in casinos, especially for gambling purposes, depends on specific factors such as the venue, transaction type, and local regulations.

What casino can I pay with a Walmart credit card

1. Payment Types Allowed

Most casinos, whether online or brick-and-mortar, offer several payment options. However, credit card transactions categorized as gambling are often treated as cash advances. This can lead to additional fees, higher interest rates, and limited availability depending on your card issuer’s policies.

2. Casinos That May Accept Walmart Credit Cards

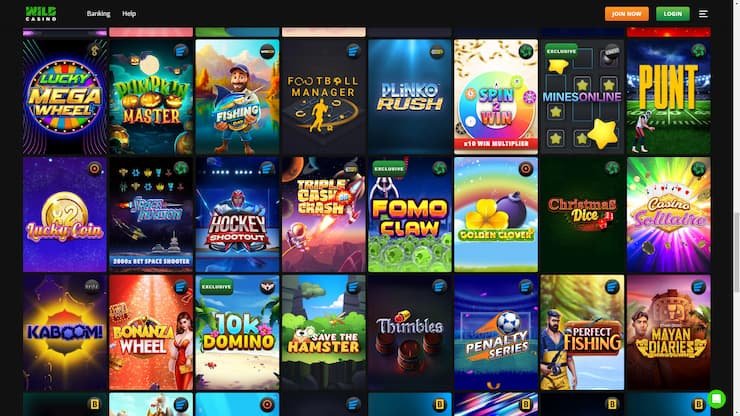

- Online Casinos: Many online gambling platforms accept Mastercard as a payment option. Some major sites like BetMGM, DraftKings, and FanDuel might allow you to use your Walmart credit card, but it may still be processed as a cash advance.

- Physical Casinos: While casinos often accept cards for hotel stays, dining, or retail, direct use of credit cards for gambling is uncommon. Instead, casinos may offer ATMs where you can withdraw cash using your Walmart credit card. Keep in mind that this may incur additional fees.

How to Maximize Your Walmart Credit Card at Casinos

1. Use a Digital Wallet

One workaround is linking your Walmart credit card to a digital wallet like PayPal, which can then be used at casinos that accept this payment method. This avoids direct cash advance charges in some cases.

2. Check Casino Payment Policies

Before visiting a casino or registering on an online platform, verify their accepted payment methods. This information is usually available in the FAQ section of their website or customer service.

3. Understand Cash Advance Terms

If your Walmart credit card transaction is processed as a cash advance:

- Fees: Expect a charge of 3–5% of the transaction amount.

- Higher Interest Rates: Cash advances often have higher APRs than standard purchases.

- Immediate Interest Accrual: Unlike regular transactions, there’s no grace period for cash advances.

Considerations for Using Credit Cards for Gambling

Advantages

- Convenience: Quick and easy access to funds.

- Security: Credit cards offer fraud protection and tracking.

Disadvantages

- Fees and Costs: Cash advance fees, higher interest rates, and lack of rewards.

- Limits on Usage: Many major banks, including those issuing Walmart credit cards, restrict gambling-related transactions.

- Gambling Policies: Some states or casinos may entirely prohibit credit card usage for gambling.

Alternatives to Using Walmart Credit Cards

If you face limitations, consider these alternatives:

- Prepaid Cards: Options like Vanilla Visa or Play+ are widely accepted at online and physical casinos.

- Direct Bank Transfers: Secure and reliable for larger transactions.

- Casino Loyalty Cards: These cards often provide benefits and perks for in-house transactions.

Pros and Cons of Using a Walmart Credit Card for Casino Payments

Pros

- Convenience: You can access funds quickly without carrying cash.

- Widespread Acceptance: As a Mastercard, the Walmart credit card is accepted by many establishments, including some casinos.

- Rewards Program: Walmart credit cards often come with cashback rewards, though these may not apply to gambling transactions.

- Fraud Protection: Credit cards provide security against unauthorized charges.

Cons

- Cash Advance Fees: Transactions at casinos may be classified as cash advances, resulting in additional fees of 3–5%.

- High Interest Rates: Cash advances accrue interest immediately at higher APRs.

- Restrictions: Many casinos and states limit or prohibit direct credit card use for gambling.

- Potential Debt: Using credit cards for gambling can lead to financial risks if not managed responsibly.

How Credit Card Transactions Work in Casinos

- Explanation of Cash Advances vs. Regular Purchases: Describe how credit card payments for gambling are typically processed as cash advances, including the financial implications.

- Card Processing Limits: Explore why certain casinos might restrict credit card use and what that means for users.

State Regulations on Credit Card Use for Gambling

- Overview of US State Laws: Explain how laws differ by state regarding the use of credit cards for gambling, including regions where it’s outright prohibited.

- Impact of Local Casino Policies: Highlight how individual casinos set their own rules regarding credit card acceptance.

Rewards and Cashback Opportunities

- Limitations on Earning Cashback for Gambling Transactions: Clarify the exclusions in reward programs for gambling-related payments.

- Maximizing Other Perks: Discuss how Walmart credit cards can still earn rewards on non-gambling purchases like dining, travel, or hotel stays at casino resorts.

Security and Fraud Prevention

- Protecting Your Credit Card Information: Tips for safe online and in-person casino transactions.

- Fraud Alerts and Disputes: How Walmart credit cardholders can address unauthorized transactions.

PEOPLE ALSO ASK (FAQs)

1. Can I use a Walmart credit card for gambling directly?

Yes, but it may be processed as a cash advance, leading to higher fees and interest rates. Many casinos limit direct credit card use for gambling purposes.

2. Are there any alternatives if my Walmart credit card isn’t accepted?

Yes, you can use prepaid cards like Vanilla Visa, bank transfers, or digital wallets such as PayPal.

3. Will I earn cashback rewards on gambling transactions?

No, most credit card reward programs exclude gambling transactions from earning points or cashback.

4. What fees are associated with using a Walmart credit card at casinos?

Cash advances typically incur a fee of 3–5% of the transaction amount, plus higher interest rates that begin accruing immediately.

5. How can I avoid cash advance fees?

Consider linking your Walmart credit card to a digital wallet like PayPal, which some casinos accept without treating it as a cash advance.

Is It Worth It?

Using a Walmart credit card for gambling is feasible in some cases but requires careful consideration of the costs and risks involved. Always ensure you are within your financial means and aware of the implications of cash advances.

For a seamless experience, What casino can I pay with a Walmart credit card. Check the specific casino’s payment policies and consider alternatives like digital wallets or prepaid cards if your Walmart credit card is not directly accepted.

By planning your payment methods effectively, you can make the most of your gaming experience while minimizing fees and complications.